Blog

Latest News

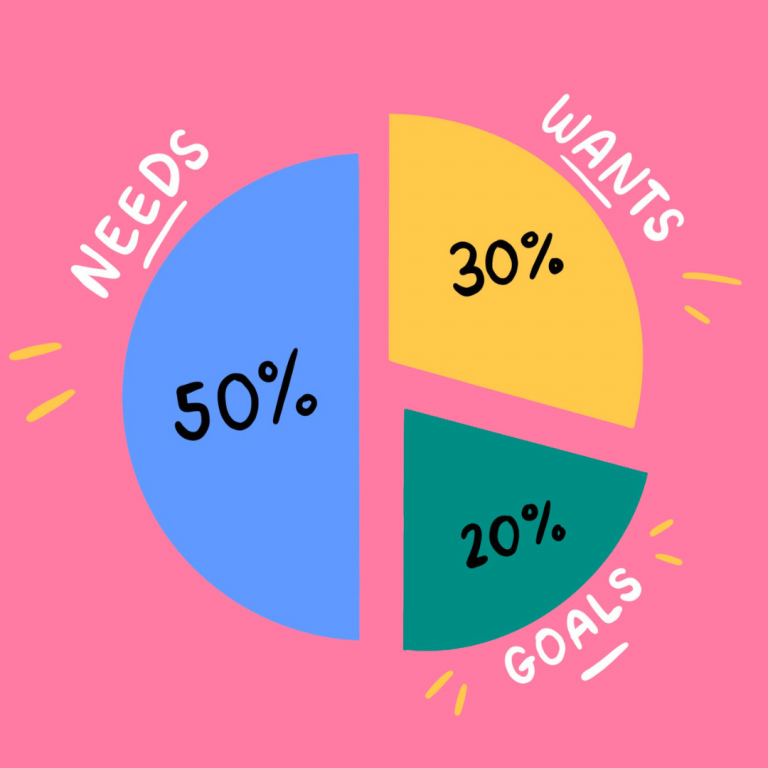

50-30-20 Budgeting Strategy

The 50/30/20 budgeting strategy approach enables you to manage your money without making too many sacrifices. It helps you to divvy up your take-home pay into three main areas – needs, wants and savings. Read more to see if this strategy is right for you.

Getting Smart About Savings

Saving money doesn’t come naturally to everyone. Some people are wired to save– for others it takes a bit more discipline. But developing good savings habits can do so much for both your financial wellbeing and your future security. These 7 tips could see you start to change your ways.

Are you getting the Age Pension you’re entitled to?

If you receive the Age Pension, recent changes to means testing for retirees could put more money in your pocket. These changes impact the assessment of certain lifetime income streams that began on or after 1 July 2019 (including any that you take up now).

Your guide to gearing

There are a number of considerations when it comes to gearing, the investment assets you may choose to gear and the way you structure your debt.

Five charts on investing to keep in mind in rough times

It’s natural to feel nervous when markets fall, but history tells us that markets trend upwards in the long run – and switching investment options at the wrong time can have a negative impact on your overall long-term invest.

How to spend without getting into debt

Is it really possible to live within your means and still enjoy life? The answer is yes and with just a few important changes you can start spending less and lose the debt.